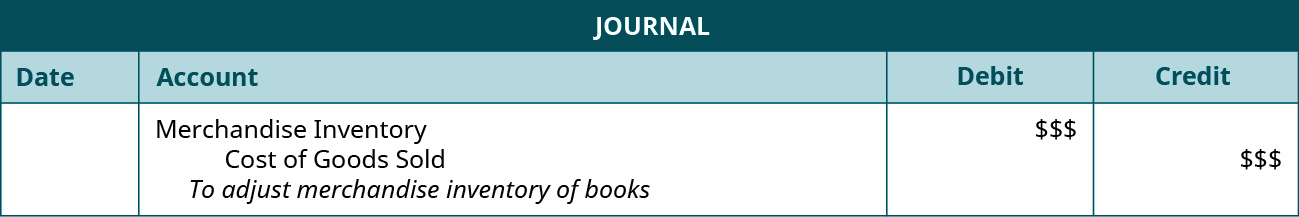

This purchase account can be a temporary account to hold all the inventory purchases for a given accounting period. Therefore, before any adjusting entries, the balance in the merchandise inventory account will reflect the amount of inventory at the beginning of the year, as indicated in the following T-accounts. The example below shows the journal entries necessary to record inventories under the periodic system.

2 Perpetual and Periodic Inventory Systems

- Small inventory levels and limited stock won’t take more than a couple of hours to count, and the cost of goods sold can be estimated through very few simple calculations.

- The inventory increase will not update, we only use the temporary account (purchase).

- In this example, the physical inventory counted 590 units of their product at the end of the period, or Jan. 31.

The information can be more robust, with exact purchase costs, sales prices, and dates known. Although a periodic physical count of inventory is still required, a perpetual inventory system may reduce the number of times physical counts are needed. Under periodic inventory procedure, a merchandising company uses the Purchases account to record the cost of merchandise bought for resale during the current accounting period.

How much are you saving for retirement each month?

Some companies do not keep an ongoing running inventory balance as was shown under the perpetual inventory system. Under periodic inventory procedure,the Merchandise Inventory account is updated periodically after a physical count has been made. Usually, the physical count takes place immediately before the preparation of financial statements. This method is most effective for a company accounting principles with a small amount of inventory due to the labor required to do a physical count of inventory. Companies using periodic inventory procedure make no entries to the Merchandise Inventory account nor do they maintain unit records during the accounting period. Thus, these companies have no up-to-date balance against which to compare the physical inventory count at the end of the period.

Time Value of Money

This means that any changes in inventory from the sales or purchases the business makes that year are not recorded until December 31st. Notice that there is no particular need to divide the inventory account into a variety of subsets, such as raw materials, work-in-process, or finished goods. At the end of the accounting period, you need to determine your firm’s actual ending inventory and “cost of goods sold.” At first, his $100 will be shifted from Purchase Account to Inventory Account.

Periodic inventory is the inventory control system that does not keep track of the inventory balance and cost of goods during the month. The journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry posting under a periodic system. A small company with a low number of SKUs would use a periodic system when they aren’t concerned about scaling their business over time. Depending on your products and needs, you could also use a periodic system in concert with a perpetual system. Sales Discounts, Sales Returns and Allowances, and Cost of Goods Sold will close with the temporary debit balance accounts to Income Summary. This simplicity in use also makes the system more cost-effective, as it can be managed manually, and businesses won’t need to hire a trained bookkeeper or invest in expensive accounting software.

Periodic inventory is normally used by small companies that don’t necessarily have the manpower to conduct regular inventory counts. These companies often don’t need accounting software to do the counts, which means inventory is counted by hand. As such, the system is commonly used by companies that sell small quantities of inventory, including art and auto dealers. The periodic inventory system is becoming an old-fashioned method of tracking inventory, and for a good reason. The growing use of cloud accounting software has made inventory tracking incredibly easy and cheap to implement. As long as the business owner is willing to put in the time to count inventory and calculate the cost of goods sold, there’s no business expense to the periodic inventory system.

Determining the cost of the ending inventory and the cost of goods sold helps determine the periodic income and financial position. A business can account for its inventory using an inventory accounting system. Record your total discount in your journal by combining the inventory sales and the sales discount entries.

The Purchases account, which is increased by debits, appears with the income statement accounts in the chart of accounts. This accounting method requires a physical count of inventory at specific times, such as at the end of the quarter or fiscal year. This means that a company using this system tracks the inventory on hand at the beginning and end of that specific accounting period. The inventory isn’t tracked on a regular basis or when sales are executed. The periodic inventory system also allows companies to determine the cost of goods sold. Under the periodic inventory system, all purchases made between physical inventory counts are recorded in a purchases account.

While the periodic method is acceptable for companies that have minimal inventory items or small businesses, those companies that plan to scale will need to implement a perpetual inventory system. Regardless of the type of inventory control process you choose, decision makers need the right tools in place so they can manage their inventory effectively. NetSuite offers a suite of native tools for tracking inventory in multiple locations, determining reorder points and managing safety stock and cycle counts. Find the right balance between demand and supply across your entire organisation with the demand planning and distribution requirements planning features.